Stock market can be quite volatile at times, and is one of the riskiest method of investing. Many investors fall prey to the stock market, losing a lot of their money, while some of the investors have gone on to make millions in the stock market. So what is it, that differentiates the successful investors from the not-so-successful ones? It is the businesses that they invest in. The investors who lose their money in the stock market are mainly the ones that really don't know what they are doing, and are basically looking for a quicker way to get rich. The successful investors know what they are doing, and first know about the company before investing in it.

Keeping the above few points in mind while investing in company can help you pick the right stocks and control your risk, with a possibility of high returns on investment. Here's a bonus point for reading till the end.

Keeping these 5 Points in mind before investing in a company can save you from losing all your money in the stock market-

- Reading the Annual Report- The Annual Report of a Company shows the company's audited financial statements, that is its Balance Sheet and Profit and Loss Account, as well as the management's plan for the future. The company's Balance sheet shows the financial standing of the company as on the year end, while the Profit and Loss Account shows the company's Income and Expenditures throughout the year. Before investing in a company, it's imperative to know the source of the company's income, their expenditures, and whether the company is earning a profit or incurring losses. You would not want to invest in a company incurring losses, because that would mean that the company is not returning value to it's shareholders and it's future prospects are not that bright. The Balance Sheet of the company tells us all about the company's financial health. The main things to look out for are the Shareholding pattern, Debt, and Assets of the company. The Shareholding pattern shows the number of outstanding shares, and the holding of various people like the promoters, DII's, FII's general public. If the promoters have a good percentage of shareholding in the company, it's a good sign as it shows their faith in the business. Debt can be in the form of Long term borrowings or debentures, bonds etc. Too much of debt is not good for business, as it means that the company is incurring more expenditure in paying the interest of the debt than the return it's receiving. In other words, it means that the company is paying more than its earning. Too little of debt is also not a good sign as it shows that the company is not using the financing available to it to expand its operations. The asset side of the company shows where it has been investing money or where its using the money like purchasing Plants and Machinery, Land and so on. It is important to know what assets the company has and is it utilizing them efficiently.

- The Management of the Company- When you invest in a company, you become the owner of the business, and as the owner of the business, it is important to know about the management of the business, who is running the daily affairs. Does the management know what it is doing? Is the management operating the business lawfully? Does the management have a plan for the future? Answers to all these questions help in evaluating the management of the company. The annual report gives an insight about the management's plans for the business, its future prospects and how they are planning to execute them. You can also read the news regarding the company to see if the management has been part in any unethical practices in the past, or is currently under any kind of scrutiny.

- Invest in a business you know of- This one goes without saying. Before buying product, it is obvious to search about the product, look for its features, its shortcomings, if any, and then buy the product. The same goes for investing in a company. Investing means buying a share or portion of a company. Investing in a business you don't know of, is like buying a product you know nothing about. It is important to invest in a business you have knowledge about, so that you are able to understand the company's environment, its financials, and whether the management of the company is going down the right path.

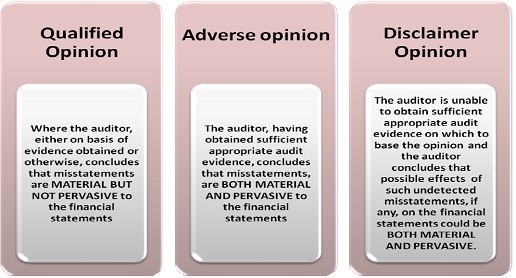

- Read the Auditors Report- The Auditor of the company scrutinizes the financial statements of the company to see whether they present a true and fair view of the company's financial position, and if not, then what the company is doing wrong. Reading the auditor report tells you whether what the company is saying is true or is there something that the company is hiding, or is the company indulging in any unethical practices. A qualification in the auditor report can mean that the management is not being honest with its shareholders and the general public.

- The Company's past performance- The company's past performance can give you an insight into how the company might perform in future. If the company has performed consistently in the past, then it is likely that the company will continue to do so in the future. The risk associated with the company is moderately low, and the return will also be moderate. But if the company has had a volatile trend of performance in the past, then investment in such a company will carry high risks, and also carry a possibility of high returns.

- Invest for long term- It is important to know that in the short term, due to some external or internal factors, the company might be facing some problems and hence it would seem that your investment is turning bad. Every business faces ups and downs in its day to day operations, which correspondingly reflects on their share price. It does not mean that the company will continue to perform bad. In the longer term, the company will get through the tough times and continue to grow the business. Look into the future to see whether the short term difficulties will really affect the company in the big run and is it worth holding on to the stock.

Comments

Post a Comment